Being a technologist, I have always focused on making money and rarely paid attention to smartly making it work for me. I am sure many others, especially those who are not from a family that is already into business, might not always know about disciplined usage of money.

The only aspect I knew as a working professional was that when you save a good % of your earnings, it will help in the long run.

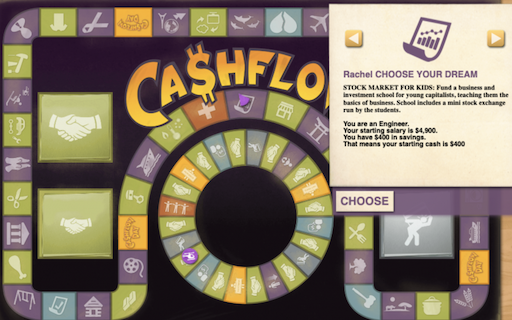

I came across this book called ‘Rich Dad, Poor Dad’ and subsequently played this online game with the same name, which taught me how to smartly put to use the money that we save.

The game presents various opportunities, similar to what life presents us, where the decisions we take, decide the way in which our financial growth happens.

Some examples are:

A house comes to the market as an investment opportunity and there is a down payment and a recurring cashflow every month.

A stock comes for a given price at a given time.

A sale opportunity comes when we can sell the house or stocks we already purchased

We have to decide the action to be taken and that decides how the game goes.

Just by playing this game, the clarity on simple concepts such as what is assets, liabilities, income, expense, cashflow and savings helps a lot.

It was a revelation to me when I realised the life lesson this game was teaching us and realised it is something that is worth teaching others too. Hence started teaching seventh and eight grade kids in my daughter’s school on this topic. Because of the fact that there is an online game involved, the kids seem to love the financial literacy course and hence I have been asked to teach this again every year in the past three years.

For any one interested in playing this useful online game for free, please go to https://www.richdad.com/products/cashflow-classic .